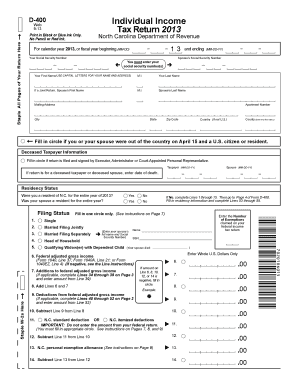

The website is a dynamic tool that provides access to information about our services, conferences, legislative initiatives, research, training opportunities, financial programs and publications. is the primary internet resource for information about South Carolina's counties and issues affecting county government. Located in the state's capital of Columbia, SCAC is a non-partisan, non-profit association that strives to Build Stronger Counties for Tomorrow by working with county officials to provide education and training, legislative reporting, research and technical assistance. Calculation: $125,000 (assessed value) x 1.37 (tax rate)/100 = $1,712.The South Carolina Association of Counties (SCAC) is the only organization dedicated to the statewide representation of county government in South Carolina. To calculate the tax, multiply the assessed value by the tax rate and divide by 100. This is assessed per hundred dollars of assessed value. The City of Kannapolis ($0.63) and Cabarrus County ($0.74) combined tax rates for 2020 are $1.37. Also assume it is located within the City of Kannapolis. To calculate the tax on your home, let's assume it has a taxable value of $125,000. Tax Rates for Fiscal Year Jto June 30, 2023Ĭalculations are based on $100 per valuation Jurisdiction Related information: Real and Personal property value billed by the Tax Office for 2020 was 4,126,547,605 and Registered Motor Vehicle value billed for 2020 by. The tax rates for each district is set as part of the budget process and takes place no later than June 30 of each year. This includes the county, seven cities or towns and 16 fire districts. The Collections office collects taxes for all tax jurisdictions located within the County.

Mount Pleasant Planning and Adjustment Board North Carolina has a 4.75 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 6.99 percent.Industrial Facilities and Pollution Control Financing.Home and Community Care Block Grant Advisory.Early Childhood Task Force Advisory Board.Forty-three states and the District of Columbia levy individual income taxes. Adult Care Home Community Advisory Committee Individual income taxes are a major source of state government revenue, accounting for 40 percent of state tax collections in fiscal year 2020, the latest year for which data are available.Upcoming Meetings of the Board of Commissioners.Early Childhood Education and Development.Cabarrus County American Rescue Plan Fund Allocation The state’s seven individual income tax brackets were consolidated into five (with the first two brackets eliminated), and each of the remaining marginal rates was reduced by 4 percent.Cabarrus County Career and Leadership Institute NC-30 Income Tax Withholding Tables and Instructions for Employers.Zoning Permits, Tools and FAQs Sub-menu.Amended Annual Withholding Reconciliation. Annual Withholding Reconciliation ( Instructions) eNC3.

North carolina 2020 tax tables registration#

Business Registration Application for Income Tax Withholding,Sales and Use Tax, and Machinery and Equipment Tax.

Property, Building and Development Sub-menu Income Tax Withholding Tables & Instructions for Employers.Youth Activities and Resources Sub-menu The administration has proposed forgiving up to 10,000 in debt for borrowers earning less than 125,000 a year (or couples who file taxes jointly and earn less than 250,000 annually).The company ships the table from North Carolina to the organizations address in. Human Services: Economic Family Support 2020 Instructions for Form 109 Exempt Organization Business Income Tax.Low-Income Household Water Assistance Program.Search Real Property Value and Tax Bills.

0 kommentar(er)

0 kommentar(er)